Kalman filter and pair trading

Published at May 1, 2020 · Last Modified at November 19, 2021 · 4 min read · Tags: kalman-filter statstical abitrage

Kalman filter and pair trading

Published at May 1, 2020 · Last Modified at November 19, 2021 · 4 min read · Tags: kalman-filter statstical abitrage

Pair trading is a type of cointegration approach to statistical arbitrage trading strategy in which usually a pair of stocks are tcraded in a market-neutral strategy, i.e. it doesn’t matter whether the market is trending upwards or downwards, the two open positions for each stock hedge against each other. The key challenges in pairs trading are to:

One of the challenges with the pair trading is that cointegration relationships are seldom static. I implemented a Kalman filter to track changes in this relationship between the stocks with synthesized stocks data.

These are some initil paramaters for octabe/matlab simulation:

mu=0.1;

t=1:1000;

sig=0.3;

T=1;

N=1000;

r=mu-sig^2/2;

Y=randn;

h=T/N;

sh=sqrt(h);

mh=r*h;

x0=100;

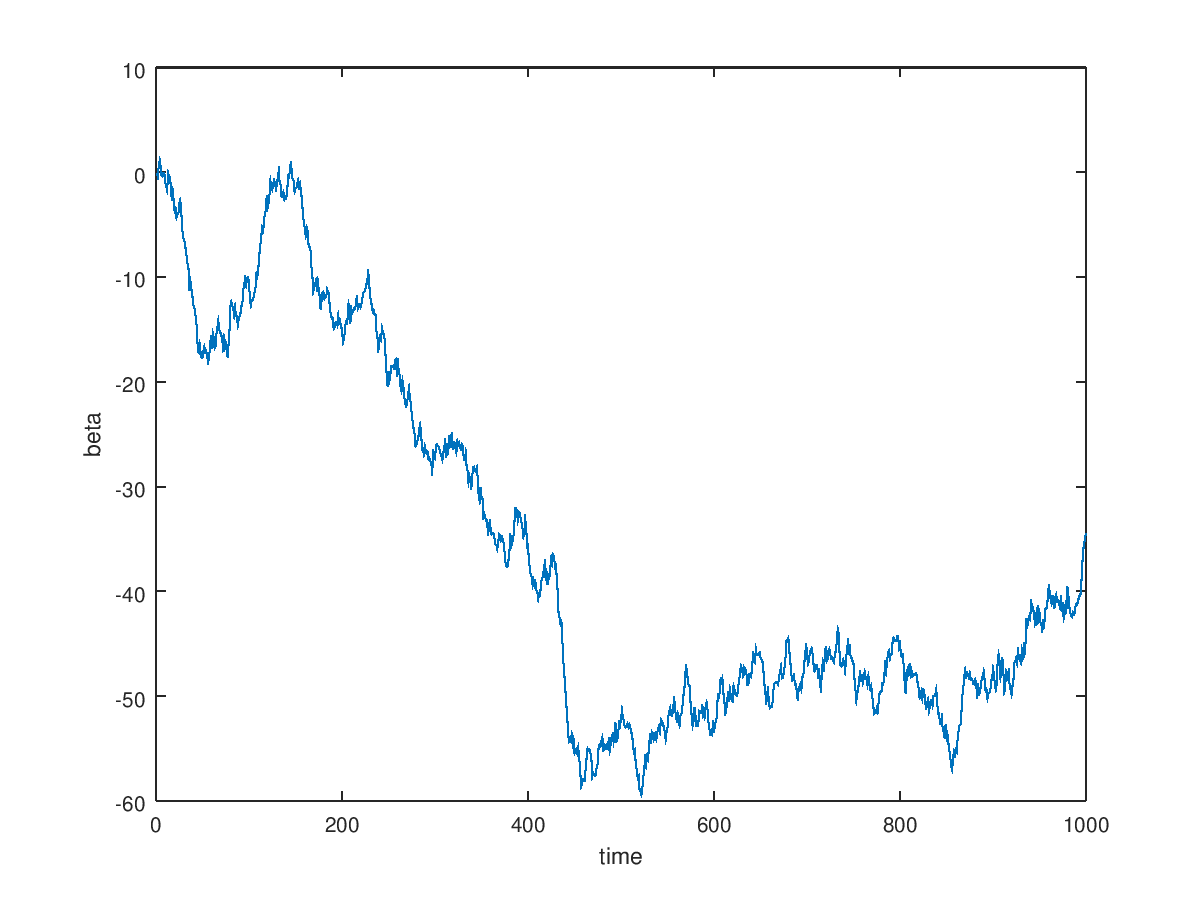

I have used the simplest form to model the relationship between a pair of securities in the following way: $$ \beta(t) = \beta(t-1) + \omega\\ \omega \sim N(0,Q)\\ $$ where beta is the unobserved state variable that follows a random walk, and W is a Gaussian distributed process with men 0 standard deviation Q.

R=sqrt (0.001);

Q=sqrt(0.00001);

beta=1+cumsum (Q*randn(size(t)));

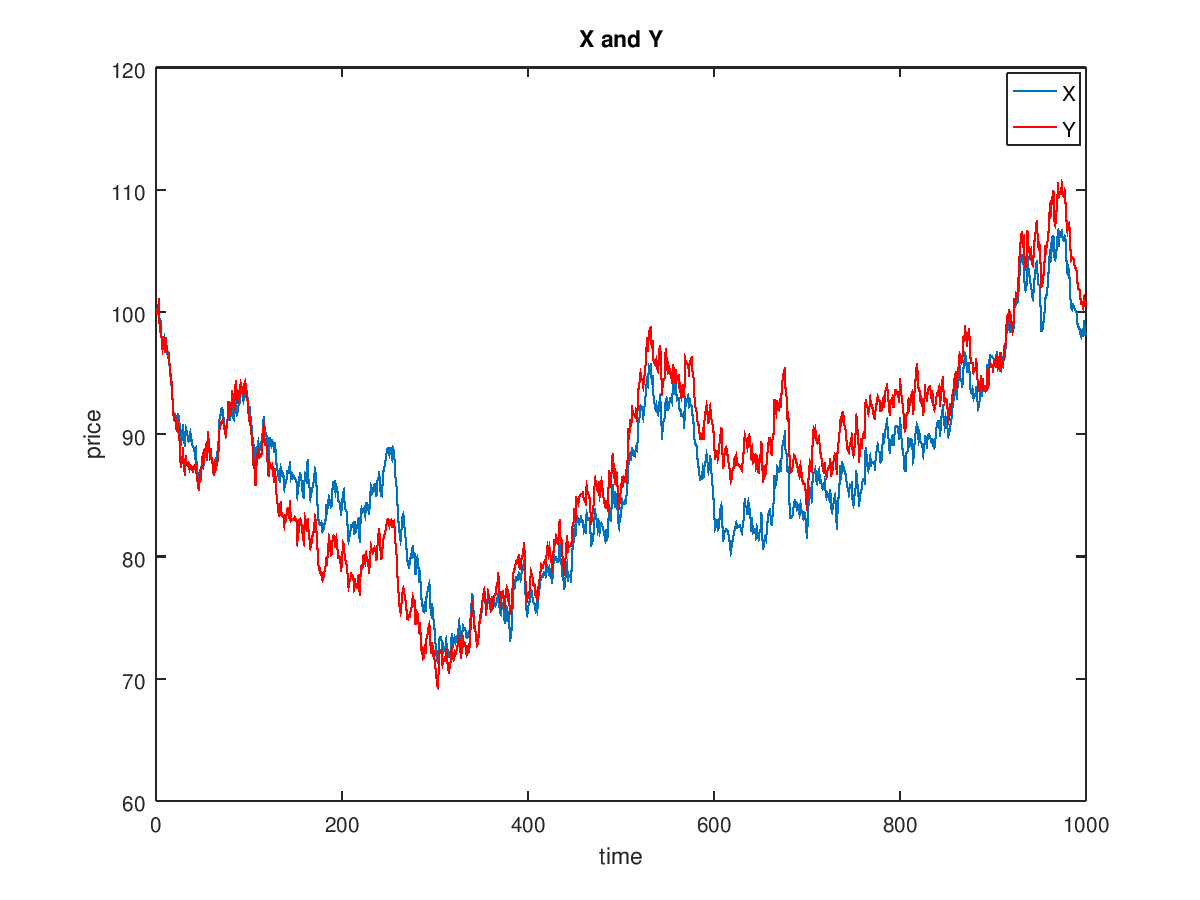

The observed processes of stock prices Y(t) and X(t) and V is gaussion disribued process with men 0 standard deviation R. $$ Y(t)=\beta(t)X(t)+v \\ v \sim N(0,R)\\ $$

clear G

X=x0;

G(:,1)=[0 x0];

for j=2:N

z=randn;

X=X*exp(mh+sh*sig*z);

G(:,j) = [j*h X];

end

x=G(2,:);

y=x.*beta + R*randn(size(t));

Instead of the typical approach to estimate beta using least squares regression, or some kind of rolling regression (to try to take account of the fact that beta may change over time). In this traditional framework, beta is static or slowly changing.

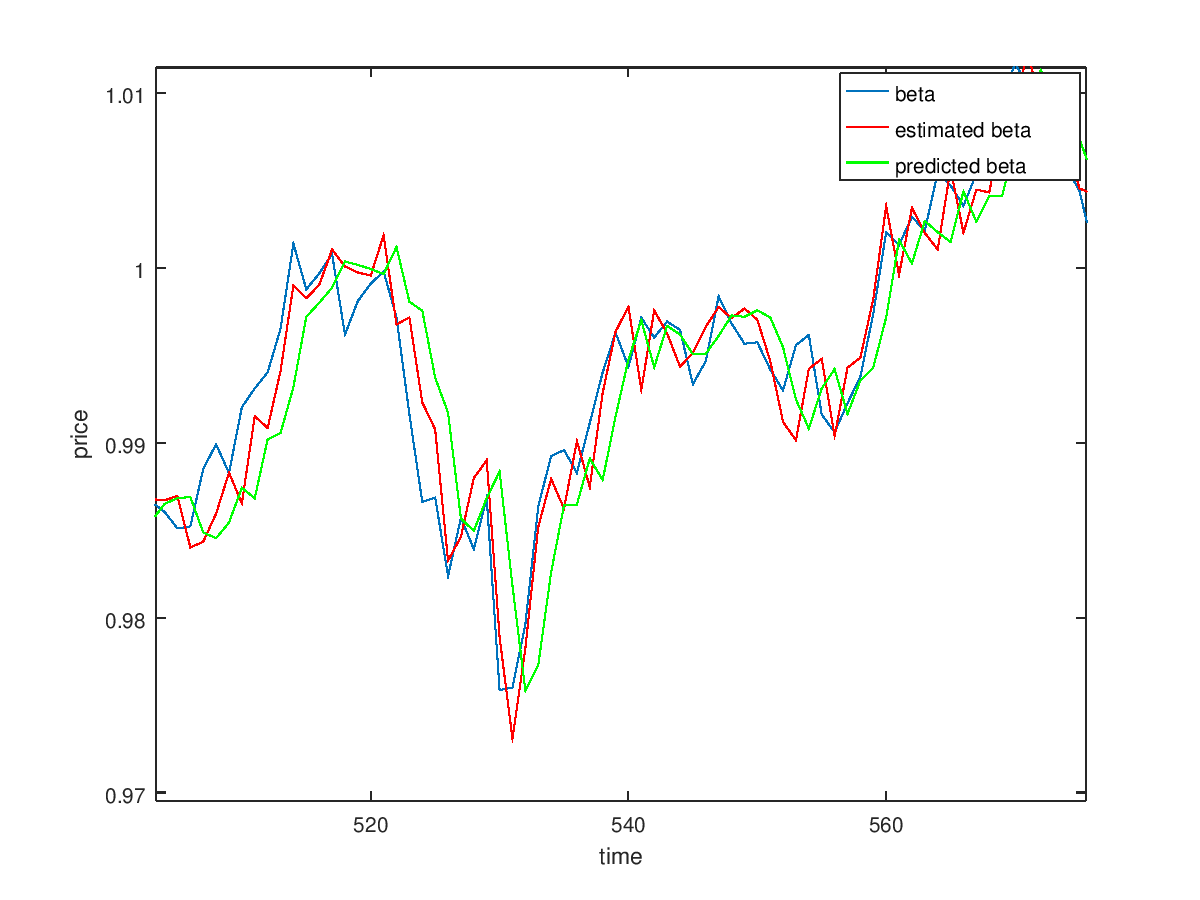

In the Kalman framework, beta is itself a random process that evolves continuously over time, as a random walk. Because it is random and contaminated by the noise, we cannot observe beta directly but must infer its (changing) value from the observable stock prices X and Y.

Kalman filter has very complicated mathematical and statistical theory behind it. See here for tutorial. Kalman filter algorithm has two states:

Q=0.8;

H=1;

P=1;

K=1;

F=[0.1 0.1 .8 ];n=3;

beta_est(1:n)=beta(1:n);

clear PP

for i=n+1:size(t,2)

%Prediction

beta_est(i)=F*beta_est(i-n:i-1)';

P=F*P*F'+Q;

% uses to decide for trade since index 'i' is a later time, and we have info till time 'i-1'.

beta_pred(i)=F*beta_est(i-n:i-1)';

% update , it time 'i' and the stock info at this time is known

r= y(i)/x(i) -beta_est(i);

K=P^1*H'*(R+H*P^-1*H')^-1;

beta_est(i)=beta_est(i) + K*r;

P=(ones(1,1)-K*H)*P;

PP(end+1,:) = [P K];

end

The following figure diplaye kalman filter resolt. The blue graph is the orignal beta, which is hidden variable and cannot diplayed directly. The green one is the preidcted beta which is used by the trade algorithm to take descitiopn about trade. The red graph is estimated beta which calculated right after the update stage.

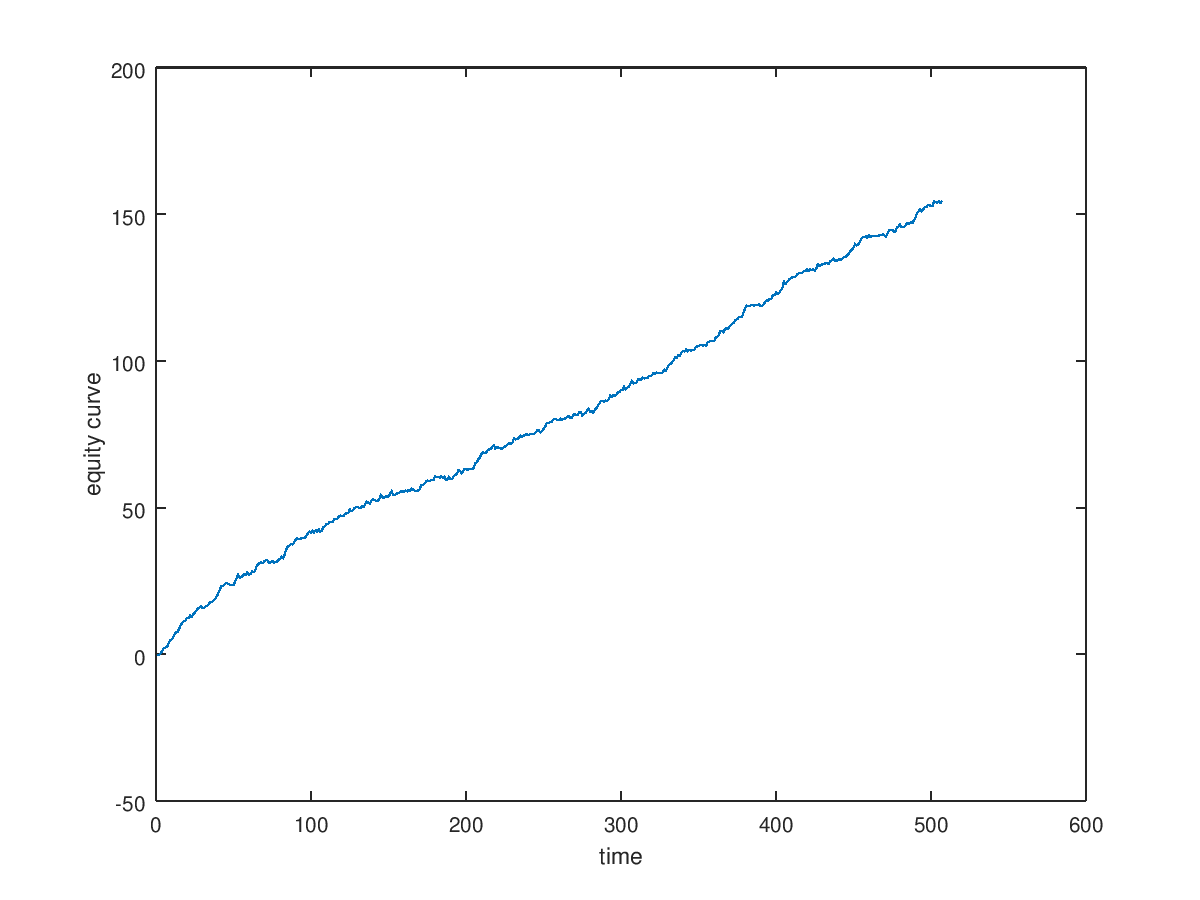

The trading algorithm is very simple and show great resoluts: $$ position(t)=\left\{ \begin{array}{ll} 1 & , beta>0 \\ -1 & , beta<0 \end{array} \right. $$

ii=find (y-beta_pred.*x>0.0);

s=y- beta_pred.*x;

s=[0 diff(s)];

ii=ii(10:end); % ignore the converegance time of kalman filter

figure;plot (cumsum(s(ii)))

xlabel('time');

ylabel('equity curve');

The results above are only theoretical and to apply this approach to real stock there arise a lot todo:

The code for this example is written in Matlab/octave and can be found here.

[1] http://jonathankinlay.com/2018/09/statistical-arbitrage-using-kalman-filter/

[2] https://www.intechopen.com/books/introduction-and-implementations-of-the-kalman-filter/introduction-to-kalman-filter-and-its-applications

[3] https://robotwealth.com/kalman-filter-pairs-trading-r/

[4] Algorithmic Trading: Winning Strategies and their Rationale, Wiley, 2013